reverse sales tax calculator ny

Sellers pay a combined nyc nys transfer tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices. For tax years before 2018 you have until October 15th of the year after making a conversion to reverse it and avoid the related tax liability.

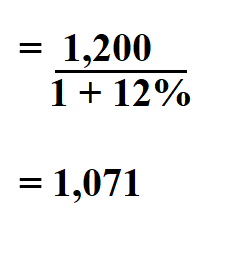

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

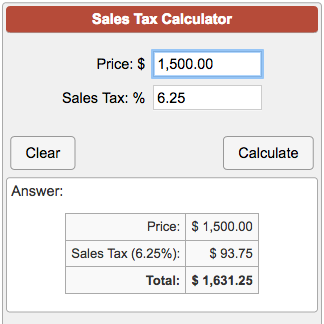

. This sales tax calculator is simple. This includes the rates on the state county city and special levels. Here is the Sales Tax amount calculation formula.

New York has a 4 statewide sales tax rate but also has 639 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254. Margin of error for HST sales tax. The sales tax rate in New York New York is 888.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Sellers pay a combined nyc nys transfer tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above. To calculate the amount of sales tax to charge in New York City use this simple formula.

New york city sales tax rate and calculator. Reverse Sales Tax Calculations. For a more detailed breakdown of rates please refer to our table.

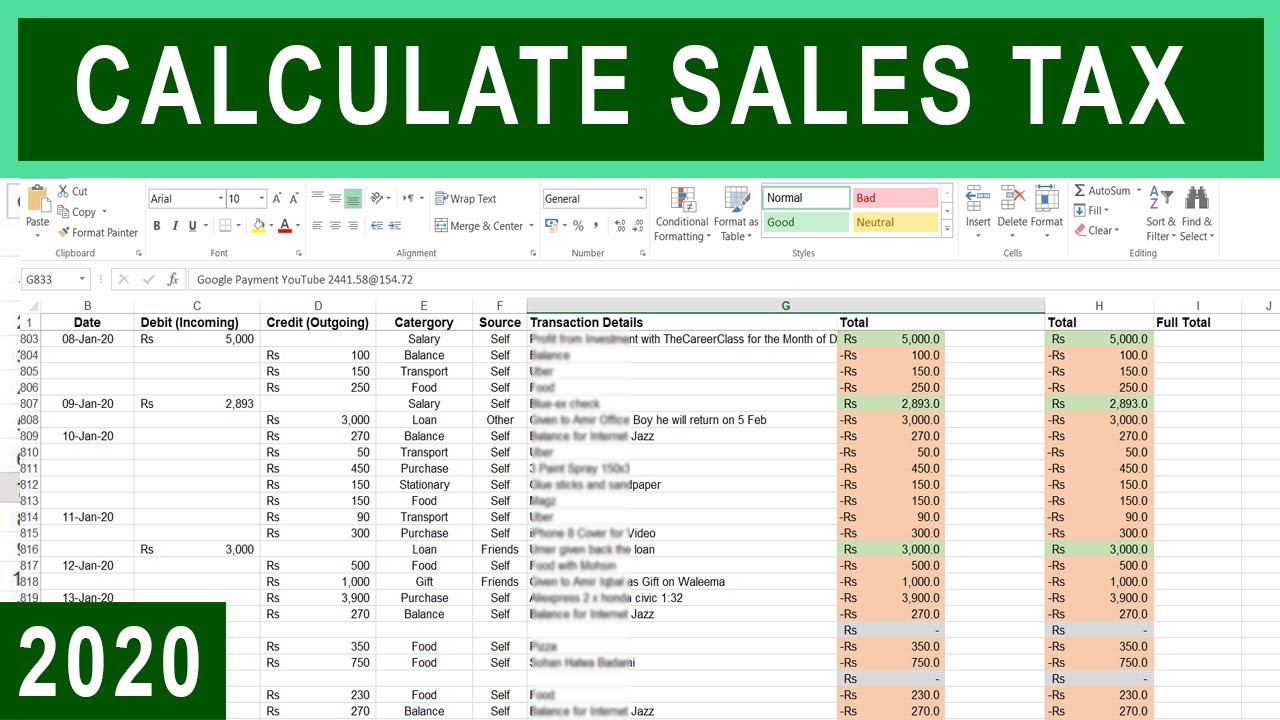

Next a sales tax is calculated as well as a total purchase price including. The Mansion Tax in NYC is a. Enter the sales tax percentage.

Here is how the total is calculated before sales tax. Just enter the five-digit zip. The highest possible tax rate is found in New York City which has a tax rate of 888.

See also the reverse sales tax calculator remove tax on this page. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax. Or to make things even easier.

If the purchase comes to 100 the sales tax in new york city would be 850 100 x 00850. Here is how the total is calculated before sales tax. Due to rounding of the amount without.

The average total car sales tax paid in New York state is 7915. Just enter the five-digit zip. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

Enter your before tax purchase price followed by the sales tax rate in your area. New York is one of. The reverse sale tax will be calculated as following.

Sales tax total amount of sale x sales tax rate in this case 8. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to. Use the Sales Tax Calculator to calculate sales taxes on a pretax sale price.

For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848.

Sales Tax Calculator Tax Me On The App Store

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Calculate Sales Tax In Excel

Does Hawaii Charge Sales Tax On Services Taxjar

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

How To Calculate Sales Tax Backwards From Total

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Does Hawaii Charge Sales Tax On Services Taxjar

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Easy Net Investment Income Tax Calculator

Online Sales Tax Compliance Ecommerce Guide For 2022

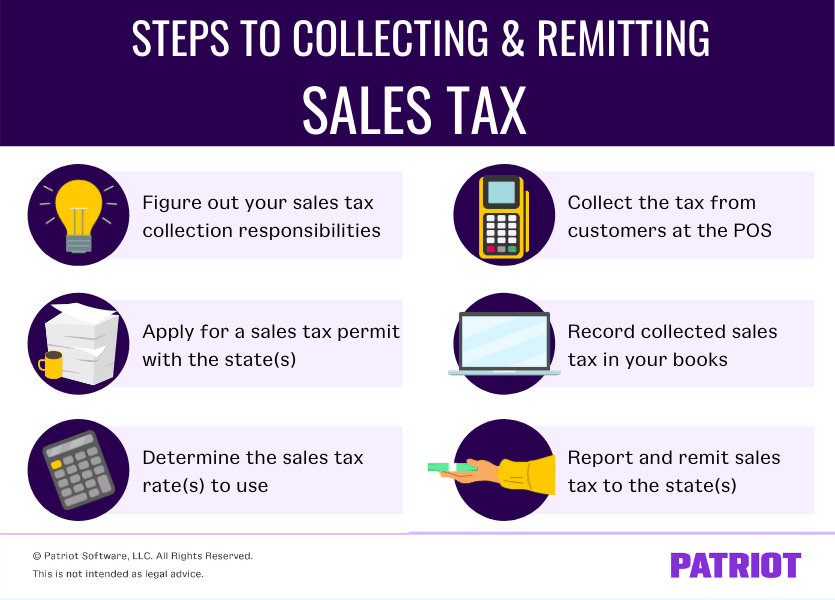

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price